Have you ever asked yourself,

How do I take care of my loved ones even if the unfortunate happens?”

Everybody knows happiness is more important than money. But without money,

it becomes much harder to attain happiness. You need money to be able to live,

support your family, and function in society. Thus, you need to know how to handle

it properly.

How do you spend your monthly income?

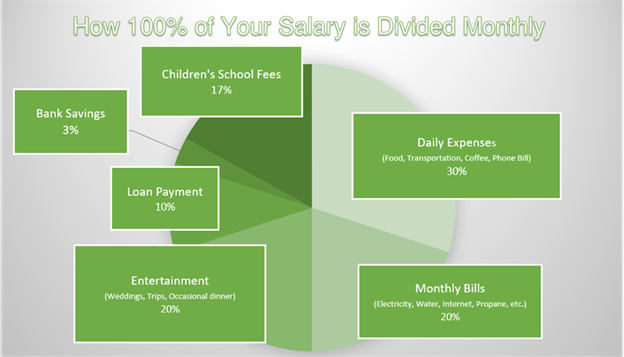

For an average office worker with children and a house and/or car loan, your monthly expenses would look something like this:

You barely have enough to save in your bank account, how can you afford a Life Insurance policy that you may never use in your life time? Have you ever thought that, with this expense, how would you support yourself and family when you are old and your children are not able to support you? The thing is Life Insurance also works as a savings plan. Life Insurance provides you with up to a 170% benefit when it matures. In addition, having Life Insurance enables you to save up early on when you are still young and healthy. You’re going to need it when you are old and retired!

Up to 170% maturity benefits!

But… Should any unfortunate event happen, Life Insurance creates an immediate asset for your family when they need it most. According to a National Police Report, during the first 9 months of 2020, there were a total of 2,430 traffic accidents with 1,257 deaths and 3,663 injured. This is traffic accidents alone, without counting deaths from other causes yet. This may have never crossed your mind, but people pass away everyday from events that they never expect to happen. As the breadwinner of the family, without you, how will your family afford to spend on much‐needed daily expenses? Would they face the possibility of losing their home and/or car because they could not pay off their loans? Will your children be able to attend university when they grow up or even manage to finish their schooling? Who will support your retired parents?

Will they face the possibility of financial hardship?

Life Insurance is not for you.

It’s for your loved ones.

Their future depends on you. Who else could they depend on if you are not there or not able to earn anymore income? After all, you are the captain of the ship. Whether the ship reaches its goal or not depends solely on you. Life Insurance works as a two‐way life vest for your family regardless of what happens in the future. It provides you extra benefits when it matures and if you are not there, it makes sure that your family’s basic needs are met and helps protect them from financial difficulties.

Our Recommendation:

- Check your monthly expenses again! You may find that you have spent more on unnecessary things than you think!

- Prioritize what you need, what you can give up, and what you can spare for the future. Save for the unexpected!

Love is sacrifice. Purchasing Life Insurance is an act of love. It’s not for you, it’s your gift for your loved ones and it’s more affordable than what you think!

If you plan to save $100 per month for 35 years starting from the age of 25, you’ll be able to save $42,000 when you are 60 years old. That’s the amount you get for saving less than $5 a day!

With the same amount of saving, $100 per month, for 35 years starting from the age of 25 with Insurance you will get up to $71,400 at the end of 35 years.

But what if an unfortunate occurrence happens to you before you turn 60 years old? With Life Insurance, your family will receive your last parting gift of $42,000 or $84,000 even though you have not reached your savings goal yet. This is for them to cover immediate expenses that they did not expect to have.

What is your ultimate goal for your family? You already work hard every day for them. Don’t let your effort goes to waste!

For more information on Life Insurance from Forte Life, please contact:

Phone number: 023 885 077/098 802 802

Email: info@fortelifeassurance.com

You can also find out more on Forte Life !

#ForteLife #SmartPlanning