As a parent, all of us wish the best for our children. Once we start a family almost all of our decisions and actions are aiming toward our child bright and successful future.

We all commit to raise our children well and give them the best to succeed in life. To support our children, we put them through education, from pre-kindergarten and all the way up to university and beyond.

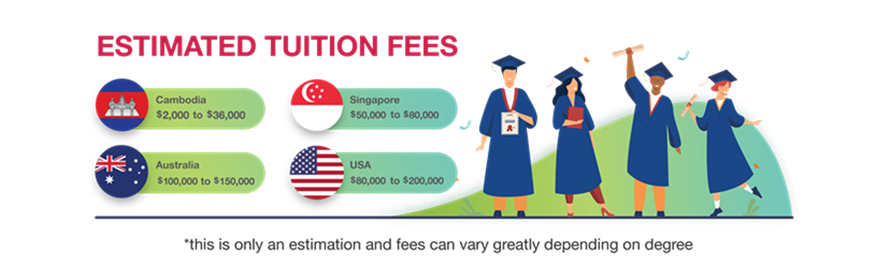

Putting our children through university is not easy. The cost of tuition across the globe is often in the tens of thousands, if not hundreds of thousands.

Facing the costs, it seems like a daunting task to be able to save so much for our children’s university education.

“How could I ever save so much while supporting my family’s daily life?”

“What happens if something should happen to me and I can no longer earn money for my family?”

These are the questions that may often cross our minds when thinking about our children’s future.

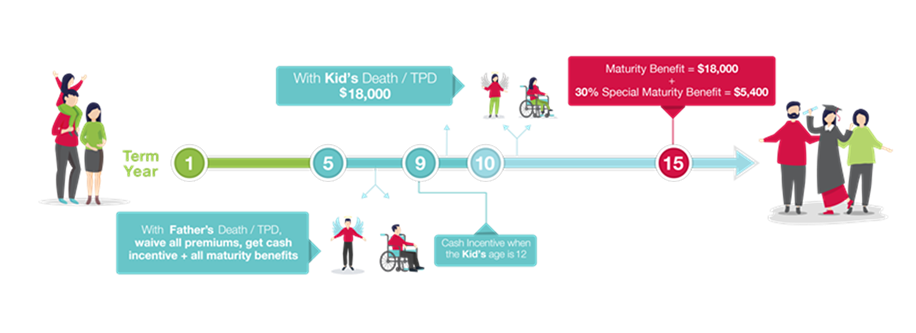

This is where Forte Life comes in. With our Forte Life Education Insurance policy, we can help you guarantee to have your child finish their education, no matter what. The policy allows you to set aside a small amount of money every month from 10 to 17 years. It also ensures that should anything unfortunate happen to you, your family or your children will receive a lump sum payment that can go towards your child’s education or anything else you wish.

In addition to your guaranteed lump sum payment at the end of your policy term, you are also entitled to a special maturity benefit to go along with all the money you saved!

Mr. Panha, has a 3-year-old daughter and has recently become more worried about the COVID-19 pandemic. He has been looking into ways to secure his family’s future, especially if something happens to him.

Mr. Panha is a businessman who must travel and meet potential clients very often. Because of such a high-risk job especially in this current pandemic, he is very worried about his family’s financial wellbeing and the future of his child if the worst were to happen to him. So, he has made a good decision by signing up to Forte Life Education policy.

Forte Life Education offers him a special $100 Education Allowance once his son turns 12. On top of this $18,000, should his policy come to maturity, he will receive an extra $5,400 in Special Maturity Benefit, bringing his lump sum payment total to $23,400. An extra 30% benefit on top of his savings!

The lump sum payment at the end of the policy is great, but more important this is that Mr. Panha does not have to worry any more should unfortunate event happen to him. It is the key feature that allows Mr. Panha to have peace of mind, knowing that whatever happens, his family will have the necessary funds to put their child through education.

Securing your family’s future, no matter the circumstances, is just a few simple steps away!

Give us a call at 023 885 077 or 098 802 802 and we’ll help you reach a better future for your family!

#ForteLife #LifeEducation